$2.52 -0.35 ( -12.32% ) 94.7K

NYSE AMERICAN: EFSH

Company Overview

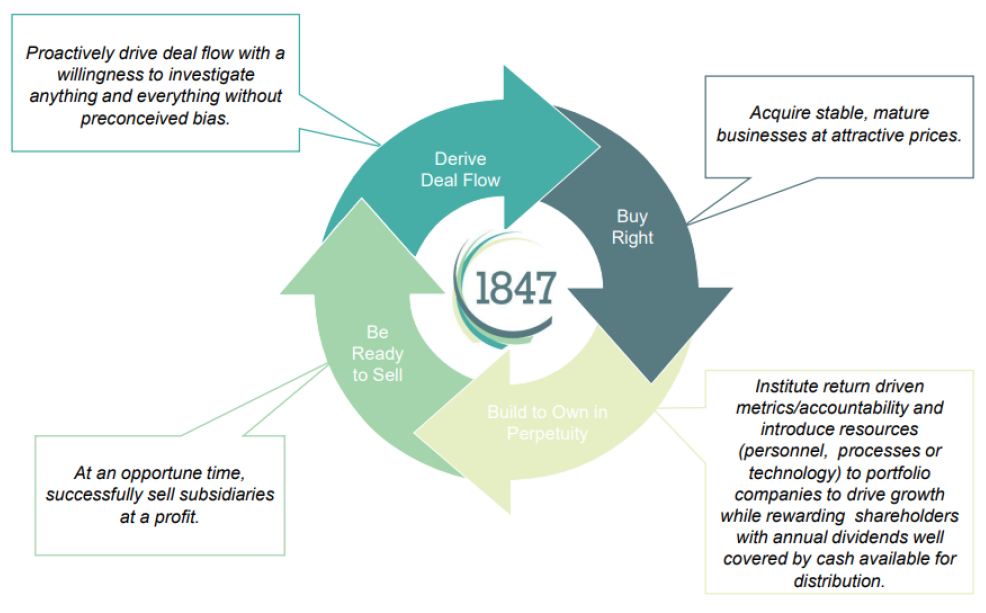

1847 Holdings LLC, a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue and Principal of Lazard Freres Strategic Realty Investors. EFSH's investment thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises and lower-middle market businesses with limited exit options, despite the intrinsic value of their business. Given this dynamic, EFSH can consistently acquire "solid" businesses for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at considerably higher valuations than the purchase price (as successfully demonstrated with the mid-2020 IPO of 1847 Goedeker on the NYSE American) and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to EFSH's ability to pay regular and special dividends to shareholders.

Value Proposition

EFSH employs a unique public, private company holding platform that combines the attractive attributes of private, lower-middle market businesses with the liquidity and transparency of a publicly traded company. Its only public-company comp, Compass Diversified Holding (NYSE: CODI), has a market cap of approx. $1.4 billion as of Q3 2023 and trades for approx. 0.6x trailing 12-month revenues; comparatively, EFSH trades for 0.05x trailing 12-month revenues, representing more than 10x upside potential to reach a similar peer valuation.

EFSH seeks opportunities for growth and margin improvement of its subsidiary holdings through additional resources and implementation of return-driven metrics and accountability. The Company demonstrated its ability to execute this model with its acquisition and spinoff of 1847 Goedeker (NYSE American: GOED). Acquired for a $7.1 million investment in April 2019, EFSH spun out GOED on the NYSE in July 2020, increasing the value of its holdings to $23.4 million (55% of the total enterprise value of $58.5 million at the time of the IPO). EFSH then followed through on its commitment to share its success with shareholders by completing a special dividend of its GOED shares in October 2020. Leveraging an expansive network of deal flow contacts in a niche of the private company arena often overlooked by investment banks and larger private equity funds, EFSH is ideally positioned to scale and manage its portfolio, repeat the success of GOED, and ultimately generate significant value for its shareholders.

Proven Track Record

Former Goedeker’s subsidiary’s performance post-IPO proves 1847 Holding’s ability to unlock and create value.

DEAL SUMMARY:

- Acquired April 2019 at an Enterprise Value of $6.2 million

- Transaction: $1.5 million in cash, $4.1 million promissory note, and up to $0.6 million in earn out payments

- Goedekers’ Enterprise Value at IPO: $58.5 million

- EFSH distributed its 2.66 million shares of GOED to shareholders in Q4 2020

- EFSH Shareholders received 0.71 shares of GOED for each share of EFSH owned at the record date

Overview:

1847 Goedeker Inc. (now Polished.com) is an industry leading ecommerce destination for appliances, furniture, and home goods. Since its founding in 1951, Goedekers has transformed from a local brick and mortar operation serving the St. Louis metro area to a respected nationwide omnichannel retailer that offers one-stop shopping for national and global brands.

Market Data

Investment Highlights

-

Solid foundation with four operating segments and double-digit revenue growth

- Revenues for the nine months ended September 30, 2023 increased 36% to $53.6 million, up from $39.4 million in the nine months ended September 30, 2022

- Current operating segments: appliances; eyewear; construction; automotive supplies

- Stable, mature businesses with margin improvement and revenue growth opportunities

-

Acquisition strategy focused on value creation; robust deal flow pipeline

- Building a curated portfolio of small businesses that operate in industries with long-term macroeconomic growth opportunities, have positive, stable earnings and cash flows, face minimal threats of technological or competitive obsolescence and have strong management teams in place

- Portfolio designed to generate very attractive risk-adjusted returns for investors

- Employs an institutionalized, multi-platform approach to sourcing new acquisition opportunities; deal sourcing efforts include leverage relationships with more than 3,000 qualified deal sources

-

Strong leadership and senior advisory team

- Led by founder and CEO Ellery W. Roberts, former Managing Director of SKM Growth Investors LP, a Dallas-based private equity fund focused on recapitalizations, buyouts, and growth capital in lower middle-market companies, where he managed $400M across two funds; previously Roberts was a principal at Lazard Freres & Co., where he was a senior team member involved in the investment of $2.4B+ of capital; and worked at Colony Capital, where he analyzed and executed transactions for a $625M private equity fund

- VP of Operations Glyn Milburn provides diverse operational and strategic expertise across multiple sectors, including commercial finance, labor negotiations, and operations management.

- Senior Advisor Edward Tobin was previously Director of Global Emerging Markets (GEM), where for 15 years he managed Special Situations and Venture investing for GEM’s Partners Capital Fund